Rewarding

Quick to access and simple to use, wherever you are. One document is all that's needed

Quick to access and simple to use, wherever you are. One document is all that's needed

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

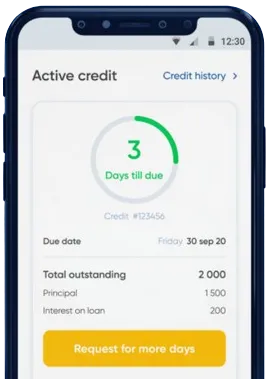

Get fast and simple solutions without stepping out. Instant fund transfers with options to extend loans

Submit an application via our app. Just fill out a simple form.

Allow 15 minutes for our decision-making process.

Access your funds; the process usually takes just a minute.

Submit an application via our app. Just fill out a simple form.

Download loan app

Payday loans have become a popular financial tool in South Africa, offering quick and convenient access to cash for individuals in need of emergency funds. These short-term loans can provide an immediate solution to financial challenges, allowing borrowers to meet their expenses until their next paycheck.

One of the key benefits of payday loans in South Africa is the convenience and accessibility they offer. With minimal documentation and quick approval processes, borrowers can receive the funds they need within a short period of time. This makes payday loans an ideal solution for urgent financial needs.

These factors make payday loans a viable option for individuals who may not qualify for traditional bank loans due to their credit history or financial circumstances.

Payday loans in South Africa offer flexibility in loan amounts, allowing borrowers to borrow the exact amount they need to cover their expenses. This can help individuals avoid taking on more debt than necessary, as they can choose a loan amount that matches their specific financial needs.

Furthermore, payday loans typically have shorter repayment periods, with the loan amount due on the borrower's next payday. This ensures that borrowers are not burdened with long-term debt, making payday loans a sustainable financial option for short-term cash needs.

Payday loans in South Africa are subject to regulations that require lenders to disclose all fees and charges upfront. This transparency ensures that borrowers are fully aware of the costs associated with the loan, allowing them to make informed decisions about their finances.

By choosing a reputable payday loan provider, borrowers can benefit from transparent pricing and avoid falling into debt traps associated with predatory lending practices.

Payday loans can serve as a financial safety net for individuals facing unexpected expenses or cash flow challenges. In times of emergencies, such as medical expenses or car repairs, payday loans can provide the necessary funds to cover these costs without disrupting the borrower's financial stability.

With their quick approval process and minimal documentation requirements, payday loans can offer peace of mind to borrowers in need of immediate financial assistance.

In conclusion, payday loans in South Africa offer a range of benefits and can be a useful financial tool for individuals in need of quick access to cash. With their convenience, flexibility in loan amounts, transparent fees, and financial safety net, payday loans provide a practical solution to short-term financial challenges. By understanding the benefits of payday loans and choosing a reputable lender, borrowers can effectively manage their finances and address their immediate cash needs.

A payday loan is a small, short-term loan that is typically repaid on the borrower's next payday. It is intended to provide quick cash to cover unexpected expenses or emergencies.

In South Africa, borrowers can apply for a payday loan online or in person at a payday loan company. The borrower will need to provide proof of income and identification. Once approved, the borrower will receive the loan amount in their bank account and will need to repay the loan, plus interest, on their next payday.

To qualify for a payday loan in South Africa, borrowers typically need to be employed, have a South African bank account, and be over the age of 18. Lenders may also require proof of income and identification.

Payday loans in South Africa provide quick access to cash for those who need it most. They are easy to apply for and can be approved quickly, making them a convenient option for those facing financial emergencies.

Payday loans in South Africa often come with high interest rates and fees, which can make them expensive to repay. Borrowers may also fall into a cycle of debt if they are unable to repay the loan on time.

Yes, payday loans are regulated by the National Credit Regulator (NCR) in South Africa. Lenders are required to adhere to responsible lending practices and must comply with the National Credit Act.